India Form 15G - Kotak Mahindra Bank 2015-2024 free printable template

Show details

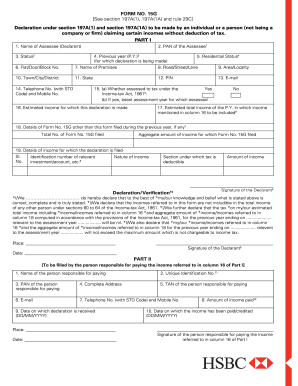

“FORM NO. 15G See section 197A(1), 197A(1A) and rule 29C Declaration under section 197A (1) and section 197A(1A) to be made by an individual or a person (not being a company or firm) claiming certain

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 15g form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 15g form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 15g online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit download 15g form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form 15g

How to fill out form 15g:

01

Make sure you have all the necessary information and documents. This includes your personal details such as name, address, and PAN (Permanent Account Number), as well as details of your income and tax liabilities.

02

Download form 15g from the Income Tax Department's official website or obtain a physical copy from your nearest income tax office.

03

Fill in the form accurately and legibly. Double-check all the information to ensure it is correct and up to date.

04

Provide details of your investments and income sources that are eligible for exemption from tax deduction. This includes interest earned from fixed deposits, savings bank accounts, and any other specified incomes.

05

Declare that your total income for the financial year is below the taxable limit and you are eligible for not having tax deducted at source.

06

Sign the form and attach any supporting documents if required.

07

Submit the form to the relevant authority, such as your bank or the income tax office, as specified by the guidelines.

Who needs form 15g:

01

Individuals who are Indian residents and are below the age of 60 years.

02

Individuals whose total income for the financial year, including interest income, is below the taxable limit.

03

Individuals who have no tax liability and wish to prevent tax deduction at source (TDS) on certain incomes, as specified by the Income Tax Act.

Fill 15g form fill online : Try Risk Free

People Also Ask about form 15g

Is it mandatory to upload form 15G?

Why is Form 15G required?

When 15G form is required?

What is Form 15G for PF withdrawal?

What is the use of Form 15G for PF withdrawal?

Is Form 15G mandatory?

What is the limit for Form 15G?

Is Form 15G mandatory?

What is mandatory for PF withdrawal?

Who submits Form 15G?

What happens if I don't submit Form 15G for PF withdrawal?

Who can submit Form 15G?

Is 15G mandatory for PF withdrawal?

What is Form 15G form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 15g?

Form 15G is a declaration form that is used by individuals to declare that their total income (excluding income from winning lotteries and horse races) is below the taxable limit. It is used to claim exemption from tax deduction at source (TDS) on fixed deposits and other investments. The form is to be submitted to the bank or financial institution before the interest is credited to the account holders.

Who is required to file form 15g?

Form 15G is required to be filed by individuals who are below the age of 60 years and have income from interest that is below the taxable limit. This form is used to reduce the amount of tax deducted at source.

How to fill out form 15g?

1. Enter your full name and contact details.

2. Enter your PAN details.

3. Select the appropriate box to indicate whether you are a senior citizen or not.

4. Enter your date of birth.

5. Enter the details of your bank and branch.

6. Enter the amount of the income you wish to exempt from tax.

7. Enter the income type (e.g. interest income, dividend income, etc.).

8. Enter the financial year for which you are submitting the form.

9. Enter your signature and the date of submission.

10. Submit the form to the Income Tax Department.

What is the purpose of form 15g?

Form 15G is used by individuals to declare that their total income is below the taxable limit and therefore, they are not liable to pay any tax. It is usually used by senior citizens, who typically have lower income, to avoid the deduction of tax at source (TDS).

What information must be reported on form 15g?

Form 15g is a document used by individuals to declare that their income is below the minimum taxable limit and that they are not liable to pay taxes on said income. The form must include the name and address of the taxpayer, the taxpayer’s Permanent Account Number (PAN) and the amount of income which is not liable to tax. Additionally, a declaration must be made that the information provided is true and correct.

When is the deadline to file form 15g in 2023?

The deadline to file Form 15g in 2023 is April 15th.

What is the penalty for the late filing of form 15g?

The penalty for the late filing of Form 15g is a fine of up to ₹10,000. The exact amount of the fine will be determined based on the amount of taxable income and the duration of the delay.

How can I send form 15g to be eSigned by others?

To distribute your download 15g form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get form 15g for pf?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tax form 15g and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit form 15g fill online on an iOS device?

Use the pdfFiller mobile app to create, edit, and share form 15g online fill from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your form 15g online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 15g For Pf is not the form you're looking for?Search for another form here.

Keywords relevant to tax 15g form

Related to 15g form tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.